Are we heading for a 2008-like situation in 2025? Is there a big bubble waiting to burst? Will there be another crash like the bankruptcy of British banking giant Lehman Brothers? What lessons can we learn from the Great Recession, which began in December 2007 and ended in June 2009?

READ ALSO: Gold near record highs: How high can prices go?

Easy money brought the US economy to the brink, then and now

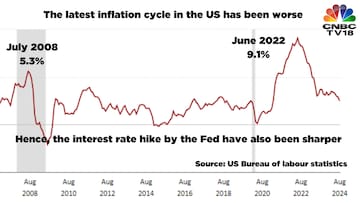

Easy credit fueled a housing boom in the United States in the early 2000s. Even those with low credit capacity were able to get a home loan. The flood of money into the system pushed inflation above 5% for two months in a row in 2008, a White House report notes. The recent inflation trend in the United States has been much worse.

READ ALSO: Should you buy a house or rent for life?

The average inflation rate in 2008 was 6.3%. In 2022, it exceeded 8.73%. Many cite the delay in the start of the rate hike cycle after the pandemic as the cause of the rise in inflation.

We now know that the biggest (and most unsustainable) bubble created in the first decade of the 21st century was that of the US real estate market, which was visible since 2004 but only burst in 2007. Where is the bubble now?

Many believe that US tech stocks could be the new bubble. Low interest rates over the past decade allowed money to flow easily into tech startups in California’s famed innovation hub, known as Silicon Valley.

It has allowed many companies like Tesla, Uber and Airbnb to thrive and the fear is that many of them could disappear as borrowing costs rise and profits remain elusive. In recent years, enthusiasm for technological advances has morphed into a euphoric rally in tech stocks like Nvidia, GoDaddy, Microsoft and Apple, which promise a new world powered by artificial intelligence.

However, Samir Bhandari, co-founder and CFO of hBits, argues that tech stocks will only experience a “healthy correction” and that lower interest rates will help them.

“Today’s technology leaders are highly profitable. While there is some hype, especially around artificial intelligence, we are not seeing the same warning signs as before the crises of 2000 or 2008,” adds Viram Shah, founder and CEO of Vested Finance.

READ ALSO: China’s economy needs stimulus to achieve 5% growth target

How did the Federal Reserve react to the looming crisis more than a decade and a half ago?

Between June 2004 and June 2006, the Federal Reserve raised the federal funds rate by 425 basis points. Interest rate hikes between In April 2022 and July 2023, the rate was 550 basis points. 100 basis points represents a percentage. The Fed has raised rates by a larger magnitude, in a much shorter period of time, demonstrating aggressiveness.

In 2007, rising interest rates burst the housing bubble. Those who took out loans during the period of low interest rates were unable to repay them. Something similar seemed to be happening in 2023 with the massive withdrawal of some American lenders, such as Silicon Valley Bank, and the highest number of bankruptcies in 13 years, according to a report by S&P Global.

READ ALSO: Why the world’s original chipmaker is in serious trouble

The U.S. Federal Reserve’s U-turn—which coincidentally began in The next rate cut, the first in four and a half years, is expected on September 18, 2007.—he began The start of the cycle of interest rate cuts from 4.75% to 2% in April 2008 was widely criticised as insufficient and late. The depth of the recession was a testament to these criticisms. The interest rate even fell to zero in December 2008, but the damage had already been done.

Why was the Federal Reserve late in cutting rates in 2007? The Federal Reserve repeatedly cited the strength of the labor market as a deterrent. Even on September 18, 2007, when Ben Bernanke cut interest rates, for the first time since June 2003, by 50 basis points, he said: “As you know, despite the fact that real GDP was close to our expectations for most of this year, employment had surprised us quite a bit to the upside.”

Current Chairman Jerome Powell has been saying similar things over the past few months as markets awaited a rate cut. It was the worse-than-expected jobs report in August, both in 2007 and 2024, that convinced the Fed chair that the time had come. History teaches us that it was too late then, and global markets hope that will not be the case this time.

According to the CME Fedwatch tool, half of market participants expect the US Federal Reserve to cut rates by 50 basis points within three days. Just as a delay in rate hikes prolonged recent inflation, a delay in rate cuts, or inadequate cuts, could worsen the slowdown in the world’s largest economy.

There are those who believe that fears of a US recession in 2025 are exaggerated.

As Barclays’ Pooja Sriram said: “We are very much prepared for a soft landing… US consumer spending has been very strong… income and wealth fundamentals are supporting spending. There are not many signs of things slowing down very quickly… it is a moderation, but it is happening in a consistent, gradual and disciplined manner,” she told CNBC-TV18 on September 9.

You can watch the full conversation here:

Nilaya Varma of Primus Partners says the Fed has been aware of a potential recession in 2025 and has been preparing the financial system for a potential downturn through measures such as stress testing. “How quickly the Fed reverses its trajectory and starts cutting rates will be key,” she said.

Vivek Kumar, an economist at Quantico Research, doesn’t expect a recession in 2025. At least not just because of the Federal Reserve.Persistent geopolitical tensions, trade fragmentation and climate change could increase risks, he warned.

#ratecutting #cycle #began #September #months #Great #Recession #CNBC #TV18